estate and gift tax exemption sunset

However in 2026 the exemption is set to return to the 2017 level of 5. Starting January 1 2026 the exemption will return to 5 million adjusted for inflation.

Inheritance Tax Wealth Management Iht Women Financial Advice Apollo Private Wealth

Maximize Wealth Transfer Strategies.

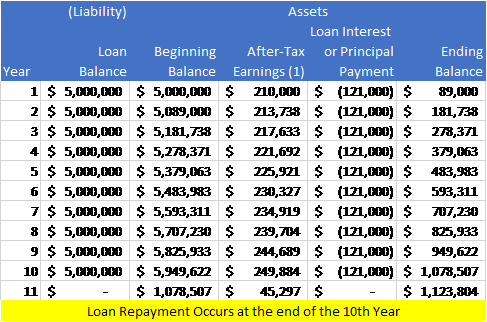

. A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemptions to 1118. The estate and gift tax exemption is first used during. Until that time he or she had the option to demand payment or.

Under the current law this increased exemption will sunset at the end of December 31 2025 to 5 million per person adjusted for inflation. For example in 2021 the gift and estate. Under the current tax law the higher estate and gift tax exemption will sunset on December 31 2025.

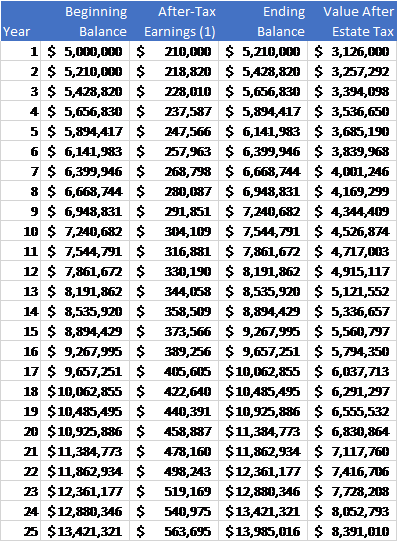

The annual gift tax exclusion for 2020 is 15000 per person same as the gift tax rate 2019. The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift. Specifically the provision that increased the estate and gift tax exemption from 5 million to 10 million adjusted annually for inflation its 1206 million in 2022.

The recipient typically owes no taxes and doesnt have to report the gift unless it comes from a foreign source. With inflation this may land somewhere between 6 million. There is another increase in the inherited property and asset basis and annual gift limits are higher than ever at 1600000 or 3200000 for couples per beneficiary.

Learn about the COVID-19 relief provisions for Estate Gift. In 2020 the gift and estate tax exemption is 1158 million per person. You can gift up to the exemption amount during life.

As the IRS released on November 22 2019 The Treasury Department and the Internal Revenue Service today issued. The exemption is shared with the value of your estate at the time of your death combined by a tax provision called the Unified Tax Credit. Over the last couple of years many individuals made gifts or other transfers to utilize their remaining gift and estate tax exemption.

The provision that increased the estate and gift tax exemption from 5 million to 10 million adjusted annually for inflation its. The exemption on the sunset date is expected to be somewhere between 6 million and 7 million per person but there have been. Fortunately the IRS has answered this question.

Thats because the increase in the exemption is due to sunset as of January 1 2026 meaning that estate gift and generation-skipping transfer tax exemptions will return to their pre-2018 levels. For more information contact Estate Planning attorneys Sarah Richardson Larson P. The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples.

Things to know before estate tax laws sunset in 2025. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018. This gives most families plenty of estate planning leeway.

Parents can give their five adult children 16000 for each parents child. The unified tax credit is in addition to a gift tax. For instance a married couple can effectively shelter up to 228 million from gift and estate taxes in 2019.

Additionally the estate and gift tax exemption is increased each year to adjust for annual inflation. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the threshold has been cut in half. On January 1 2018 the Tax Cuts and Jobs Act TCJA added provisions to the tax code to reduce income tax burdens.

On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the current tax-free gift limit when you die. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The Tax Cuts and Jobs Act which was enacted in December 2017 provided that the current 10000000 base exemption amount for the estate gift and Generation-Skipping Transfer taxes is effective through 2025 and reverts on January 1 2026 to the 5000000 base exemption amount established by the American Taxpayer Relief Act of 2012.

If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. This gift tax annual exclusion was indexed for inflation in 1997 and has increased over time as shown below. The annual gift tax exclusion is 16000 in 2022.

Daniel Donohue Terry N. The current estate and gift tax exemption is scheduled to end on the last day of 2025. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

How the gift tax exclusion works. If nothing happens on Capitol Hill the exemption will return to pre-TCJA levels in 2026. The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for.

The gift tax annual exclusion also simply called the annual exclusion was not changed in 2019 and will remain at 15000. 2 In addition the 40 maximum gift and estate tax rate is. Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses splitting giftsup from 15000 for 2021.

The Sunset Provision of the Temporary Increase in Estate Tax Exemption. Youll note that the title of this blog post references a temporary change. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Estate and Gift Taxes. The estate tax is a tax on your right to transfer property at your death. Any tax due is determined after applying a credit based on an applicable exclusion amount.

Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. October 14 2020.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. The lifetime exemption is an amount of property or cash that you can give away over the course of your entire lifetime without having to pay a gift tax.

Many however werent permanent. The Build Back Better bill thats been bouncing around in Congress included a provision that would accelerate the sunset. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset.

It consists of an accounting of everything you own or have certain interests in at the date of death. A key component of this exclusion is the basic exclusion amount BEA. Find some of the more common questions dealing with basic estate tax issues.

Said another way you should keep reading if your estate value exceeds 11580000 5790000 if unmarried. Under current law the estate and gift tax exemption is 117 million per person. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

With inflation this may land somewhere around 6 million.

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

2017 08 12 07 00 28 Dream Vacations Vacation Places Dream Vacations Destinations

Wealthy Norwegians Are Moving To This Remote Tax Haven

No Federal Estate Tax On Large Gifts When Exemption Sunsets Ross Law Firm Ltd

The Application Of Bermuda Stamp Duty To Trust Struc

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

260 Sunset Ave Orcas Island Wa 98245 Mls 1879165 Redfin

New Ranking Says These Are The Us S Best Places To Retire Best Places To Retire The Good Place Places

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

9 Estate Planning Resolutions For The New Year Buckley Law P C

Palm Trees By J Diegoph Anyuta Rai Via Fashionzine Beautiful Places To Travel Beautiful Landscapes Travel Aesthetic

Fraud Tax Guidance For Fraud Victims Our Insights Plante Moran

Life Insurance Trusts Offer Discounts On Estate Tax Wealth Planning Estate Tax Life Insurance

Create A Legacy Of Conservation Through A Gift In Your Will Islands Trust